Keeping the debit card properly is very important for your account security. If your card is lost or card information is leaked out, you may suffer from counterfeiting and even financial losses. So please beware of the following items while applying for or using the debit card:

When applying for a debit card, please truthfully fill in the application form and provide your actual personal information, and ensure to register your own mobile or frequently used phone number in the bank. You are also advised to register our e-alert service for card transactions.

Upon receipt of the debit card, please sign your name on the back of the card immediately, and make sure your signature is clear and long-lasting. Please avoid your card being damp, greasy or chemically corroded. Your signature is very important because the merchants and the bank will verify it while accepting your card transactions.

Never give your debit card or ID to anyone else for keeping, and do not rent or lend your debit card to others.

Debit card, ID and any medium recording PIN (Personal Identification Number) should be kept separately to prevent the theft of your funds by others if all of them are lost at the same time. Please avoid placing your debit card in public areas such as car and office, or in your unaccompanied baggage for consignment.

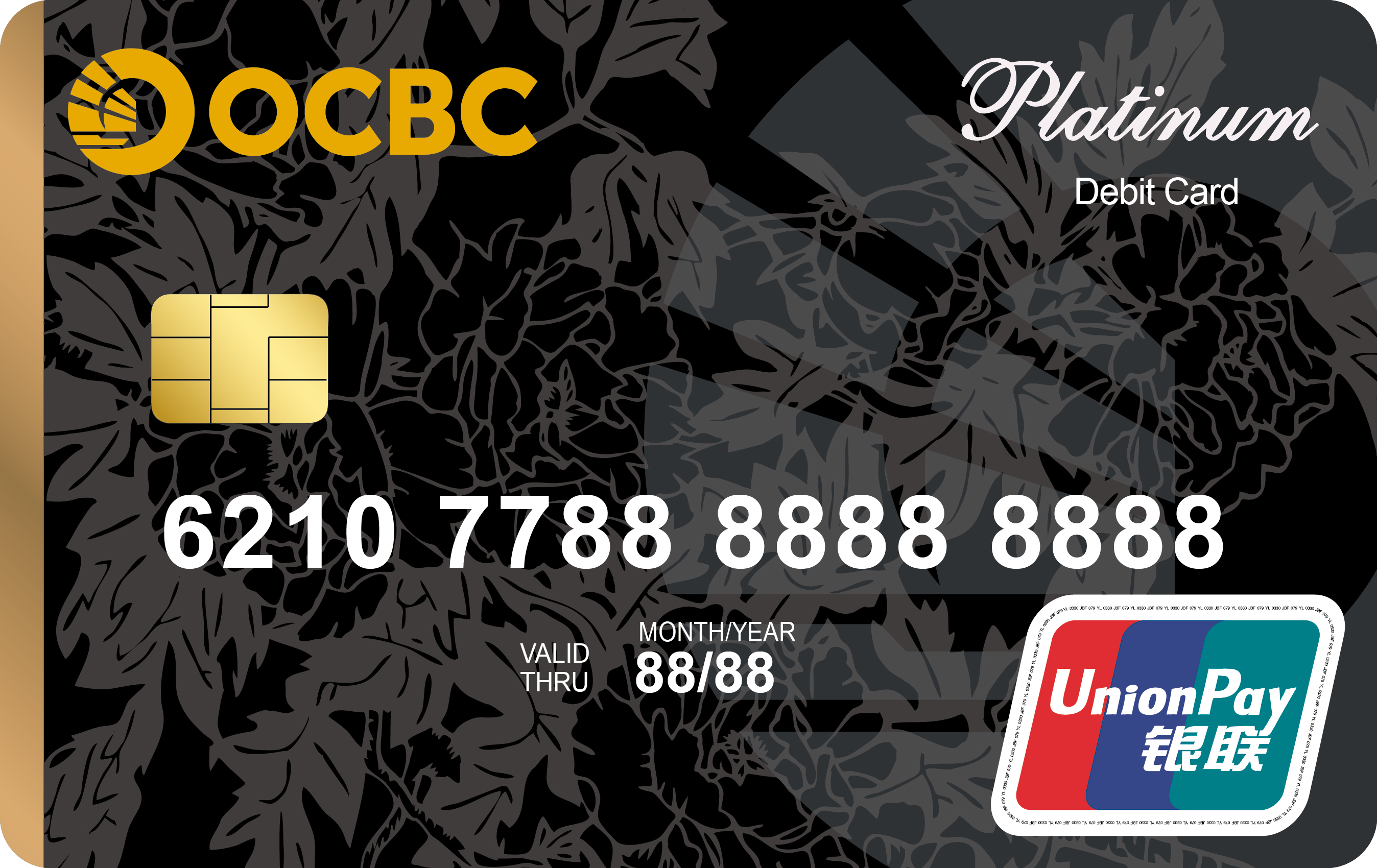

Please ensure all transaction slips to be kept properly. Do not reveal the debit card number, expire date and other information to strangers or reply to any suspicious mail or SMS (Short Message Service) message requesting such information, and do not leave such information on public computers. Please do not click those unfamiliar links or scan suspicious QR (Quick Response) codes and never enter sensitive information such as debit card numbers.PIN is a vital identity certification in the transaction process of self-service channels. A debit card that reveals the PIN is just like an unlocked safe. Therefore please pay special attention to the setting and keeping of your PIN: