Official WeChat

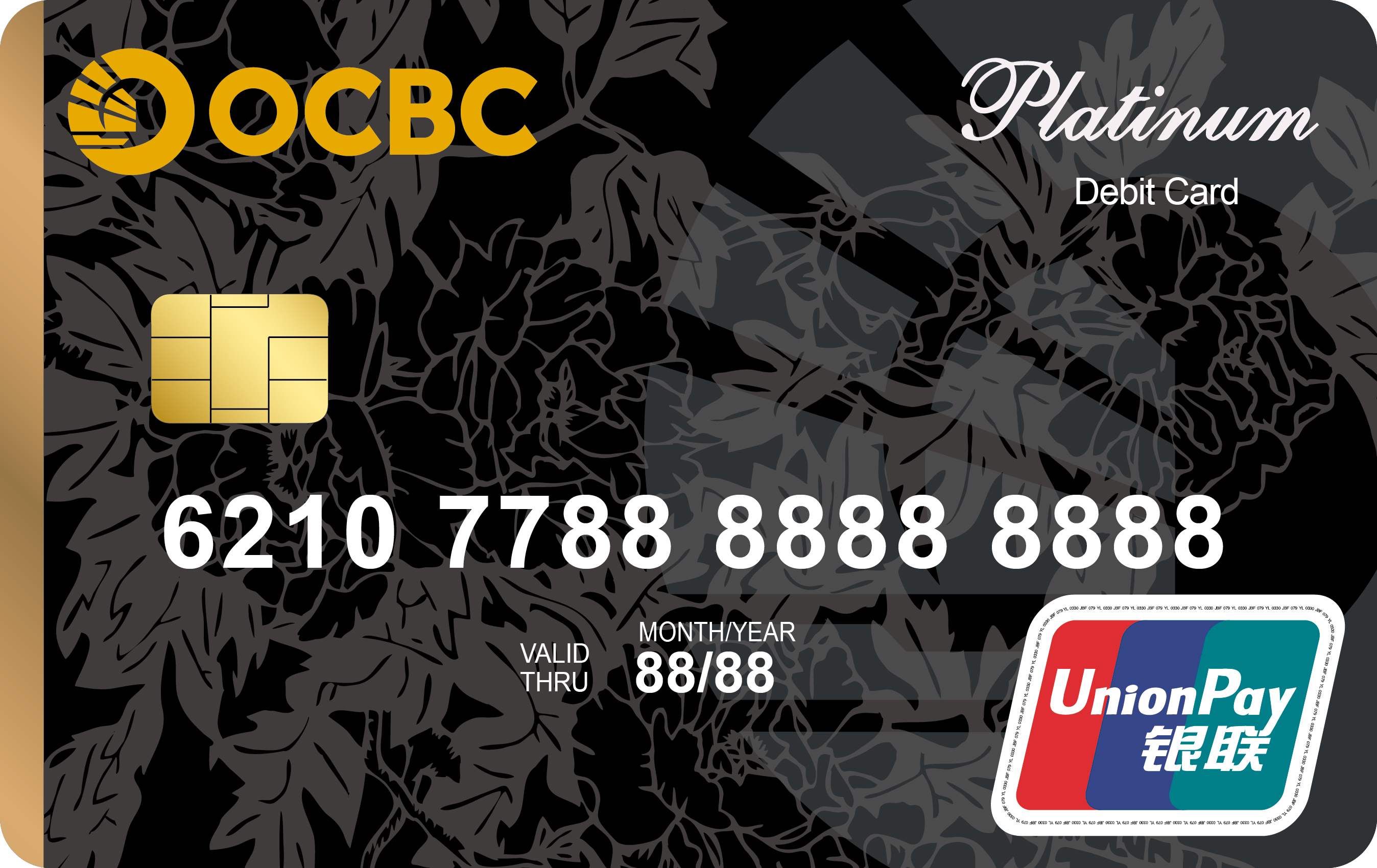

OCBC China

WeChat Banking

OCBC China

Terms & Conditions

Privacy Policy

© Copyright 2004 – 2026 - OCBC Bank Limited No:193200032W 沪ICP备09077872 沪公网安备31011502400699 The website supports IPV6